WHO WE ARE

About FLX

FLX stands to revolutionize, simplify, and modernize how asset managers and wealth management firms connect and access investment insights and products, all while leveraging a curated marketplace of leading-edge technology and professional services.

Redefining the Future of Asset & Wealth Management Engagement

FLX Networks launched in December 2019 to solve a fundamental problem: the traditional engagement model between asset managers and wealth platforms is broken. Outdated workflows—built on spreadsheets, emails, PDFs, and siloed systems—no longer meet the demands of a rapidly evolving industry. As margins shrink from rising costs and fee compression, legacy approaches and fragmented tech stacks only add to the complexity.

One platform. One agreement. One future-ready solution.

This is how modern firms grow—together.

FLX is the future of B2B engagement.

We’ve created a unified platform where asset and wealth managers connect, collaborate, and execute through purpose-built, digitized workflows. Members gain instant access to a powerful marketplace of solutions—on-demand, a la carte services designed to enhance efficiency, improve distribution, and drive measurable results.

From streamlining operational due diligence to simplifying relationship oversight and content delivery, FLX replaces chaos with clarity. Our approach dramatically reduces costs, minimizes vendor sprawl, and accelerates implementation.

FLX Integrates a Fragmented Market

Our intuitive network serves as a holistic one-stop business resource that reduces inefficiency and drives more effective and meaningful collaboration.

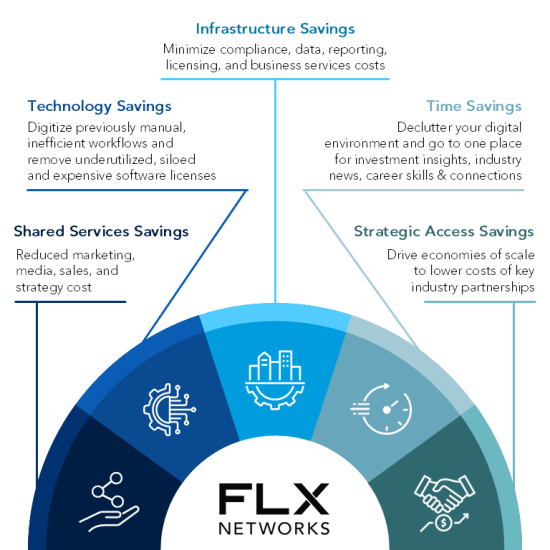

It's a centralized destination providing significant cost savings and simplified implementation, offering:

- Network: asset and wealth managers join a membership focused on driving more efficient and effective relationships

- Workflows: modernize how firms connect, collaborate, and conduct business, transforming manual, spreadsheet and phone call heavy tasks, into a seamless, compliant digital process.

- Solutions: curated marketplace of technology and business services that offer flexible implementation and coordinated integration.

An All-in-One Solution for Asset & Wealth Management

FLX's all-in-one solution includes one integrated network, offering its members— a single relationship, one communication point, and one invoice.

We help reduce the number of vendors and service providers, optimizing discretionary budgets. We reduce business friction by improving workflows and minimizing the need for technology and professional services that are not fully utilized.

Awards

News from FLX

The Strategic Case for Listed Real Estate in a Changing Global Market

03.09.26

Major Trend Index 3/4/2026

03.04.26

Major Trend Index 2/23/2026

02.25.26

Mid Quarter Update

02.19.26

Major Trend Index 2/17/2026

02.17.26

Major Trend Index 2/09/2026

02.10.26

Major Trend Index 2/02/2026

02.03.26

Economic and Market Environment First Quarter 2026

01.29.26

Major Trend Index 1/27/2025

01.28.26

The Economy vs. Itself

01.22.26

Major Trend Index 1/20/2025

01.20.26

Stock Effects + Volatility Effects: Dual Drivers of Growth

01.14.26

Why Factors Aren’t the Whole Story in Core Equity

01.14.26

Structure Over Stories: Why One RIA Chose a Different Core

01.13.26

Major Trend Index 1/12/2025

01.12.26

Breaking the Core Equity Barbell

01.12.26

Major Trend Index 1/05/2026

01.06.26

Major Trend Index 12/15/2025

12.15.25

Major Trend Index 12/8/2025

12.09.25

Major Trend Index 12/2/2025

12.02.25